Canada vs Europe: VR Gambling Innovations Compared

Imagine stepping into a neon-lit casino, spinning 3D slots, and bantering with players—all through a headset from your couch.

Welcome to the wild world of Canada VR casinos and VR gambling Europe 2025, where virtual reality gambling trends are reshaping betting! The global VR gambling market is set to hit $1.2 billion in 2025, growing at a 35% clip.

Canada’s online VR gambling Canada boasts 300,000 users, while Europe’s 2.5 million players lead the pack. But who’s winning this high-tech showdown? Canada’s got slick regulations, but Europe’s got scale.

The catch: Costs and tech gaps could trip either up. This post pits Canada VR casinos against Europe’s VR giants, breaking down adoption, tech, rules, and player vibes to crown 2025’s leader. Ready to bet on the future? Let’s dive in!

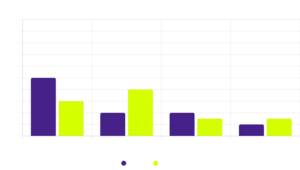

Comparing VR Gambling Adoption: Canada vs Europe in 2025

The 2025 VR gambling market is electric, with VR casinos comparison Canada Europe revealing a fierce race. VR gambling statistics paint a vivid picture: Canada’s VR casinos in Canada boast 300,000 users, a 5% slice of its 6 million online gamblers, according to iGaming Ontario.

Europe’s European VR casinos, meanwhile, lead with 2.5 million users, 8% of its 31 million betting pool).

“Europe’s VR user base surged 40% since 2023! Let’s unpack how adoption stacks up and where virtual reality gambling trends point.”

Canada’s Canadian VR casino growth is fueled by Ontario’s $500 million VR market, a powerhouse within the province’s $4.61 billion iGaming scene.

Mobile VR apps, powered by 5G, make betting a breeze on budget headsets. Europe’s Europe online gambling VR dominates with $800 million in revenue, driven by heavyweights like the UK and Malta. Their metaverse-style platforms draw crowds with immersive worlds.

|

Metric |

Canada |

Europe |

| VR Users | 300,000 | 2.5M |

| Penetration Rate | 5% | 8% |

| VR Revenue (2025) | $500M | $800M |

| Key Markets | Ontario | UK, Malta |

Virtual reality gambling trends highlight divergence. Canada leans into mobile VR, with platforms like Stake.com offering lightweight apps for casual players.

Europe bets big on metaverse casinos, where avatars roam digital Vegas strips. Europe’s scale gives it an edge, but Canada’s agile adoption keeps it in the game.

With 74% of Canadian bets on phones, mobile VR could be a game-changer. Who’s ahead? Europe’s got numbers, but Canada’s closing fast.

Technology and VR Gaming Experience Canada vs Europe

The tech fueling virtual reality gambling 2025 is reshaping iGaming, but who’s ahead in the VR casinos comparison Canada Europe? VR gambling statistics show VR casino adoption Canada at 300,000 users (5% of 6 million online gamblers), while European VR casinos lead with 2.5 million (8% of 31 million). From 5G to graphics, let’s compare how VR casinos in Canada stack up against Europe’s tech edge.

Fun fact: 60% of VR players crave live dealer games!

Canada’s online VR gambling Canada harnesses 90% 5G coverage, enabling smooth gameplay on platforms like Stake.com. Headsets like Oculus Quest 3, priced at ~C$650, make VR casinos in Canada accessible.

Europe’s VR gambling Europe 2025 excels with high-resolution visuals and haptic gloves, as seen in BitStarz’s metaverse casinos.

NetEnt powers both, but Europe offers ~30% more VR titles.

|

Feature |

Canada (Stake.com) |

Europe (BitStarz) |

| Headset Cost | C$650 | €500 (avg) |

| VR Game Titles | ~40 | ~60 |

| Latency (ms) | 10 | 8 |

| Haptic Feedback | Limited | Advanced |

Canada’s virtual gambling platforms prioritize mobile VR, with Stake.com’s apps optimized for 5G, cutting latency to ~10ms. Europe’s BitStarz builds immersive 3D casino floors with avatar interactions, leveraging fiber networks.

iGaming VR trends Canada focus on affordability, while Europe VR gambling development bets on premium experiences. Both shine in live dealer VR games, but Europe’s richer visuals give it a slight lead.

Canada’s 5G and budget headsets, though, could close the gap by 2026. Next, let’s tackle regulations.

VR Casino Regulations Europe vs Canada

Regulations shape the VR gaming experience Canada and VR gambling Europe 2025, balancing innovation with player safety.

VR gambling statistics show 300,000 VR gambling players 2025 in Canada and 2.5 million in Europe.

But how do rules stack up? Canada’s streamlined approach contrasts with Europe’s varied laws, impacting VR gambling market trends.

Canada’s VR casinos in Canada thrive under the AGCO’s flexible licensing, with 49 operators and 84 sites offering VR games like 3D poker.

The AGCO’s unified Ontario framework, backed by iGaming Ontario, requires

- KYC,

- AML compliance, and

- RG tools but keeps fees low (C$15,000 application).

This clarity fuels growth, with operators like Stake.com integrating VR seamlessly. VR casino regulations Europe, however, are stricter and fragmented.

Malta and the UK lead with robust MGA and UKGC frameworks, while France lags due to restrictive online casino laws. GDPR and AML directives, like AMLD5, mandate rigorous data privacy and transaction monitoring, raising costs but building trust.

Regulatory challenges include:

- High licensing fees (e.g., €10,000-€25,000 in Malta)

- GDPR compliance costs

- Mandatory RG tools (self-exclusion, spending limits)

- Cross-border licensing complexity

Canada’s edge lies in its cohesive rules, avoiding Europe’s patchwork of laws. While VR casino regulations Europe ensure 85% player trust in licensed sites, compliance burdens slow smaller operators.

Canada’s lower barriers let VR gaming experience Canada scale fast, with 74% of bets on mobile VR. Europe’s scale is unmatched, but Canada’s agility could lead by 2027. Next, let’s explore what VR gambling players 2025 want from these markets.

Player Preferences and VR Gambling Players 2025

The VR gambling players 2025 are redefining iGaming, with distinct tastes in Canada and Europe. VR casino adoption Canada is skyrocketing, driven by 300,000 users, mostly younger players aged 18–34.

In contrast, Europe VR gambling development boasts 2.5 million users across broader demographics, from Gen Z to Gen X. VR casinos comparisonreveals unique player preferences shaping iGaming VR trends Canada and Europe.

“Canada’s VR players spend 15% more per session than Europeans.”

In Canada, Ontario online gambling trends show slots dominating at 50% of wagers, followed by poker at 20%. Mobile VR apps, like Stake.com’s, cater to on-the-go bettors, leveraging 90% 5G coverage.

Europe’s European VR casinos prioritize live dealer games, which command 40% of wagers, with immersive blackjack and roulette thriving on PC-based metaverse platforms like WinSpirit.

|

Metric |

Canada |

Europe |

| Core Demographic | 18–34 (70%) | 18–49 (85%) |

| Top Game | Slots (50%) | Live Dealer (40%) |

| Avg. Monthly Spend | C$300 | €250 |

| Platform Preference | Mobile VR (74%) | PC VR (60%) |

Top games by wager share in VR casinos comparison:

- Slots: 50% (Canada), 30% (Europe)

- Live Dealer: 20% (Canada), 40% (Europe)

- Poker: 20% (Canada), 15% (Europe)

- Table Games: 10% (Canada), 15% (Europe)

Canada’s mobile-first iGaming VR trends Canada appeal to tech-savvy Millennials, while Europe VR gambling development draws diverse players with rich, PC-driven experiences. Spending reflects engagement:

Canadians average C$300 monthly, Europeans €250. As VR gambling market trends evolve, player habits will dictate the next big bets. Up next: the future of VR gambling.

Future Outlook: VR Gambling Market Trends for 2025–2030

The 2025 VR gambling market is poised for explosive growth, with Canada projected to reach $700 million and Europe hitting $1.1 billion by 2027.

VR gambling market trends point to innovation, with metaverse casinos, NFT rewards, and AI personalization leading the charge.

Canada’s potential shines bright—an Alberta market launch could supercharge Canadian VR casino growth by 2026.

Europe’s Europe VR gambling development benefits from unmatched scale and infrastructure, with 2.5 million VR users already.

“VR gambling could hit 15% market penetration by 2030.”

Emerging trends include:

- Cross-reality gaming blending AR/VR

- Blockchain payments for secure crypto bets

- P2E models with NFT-based rewards

- AI-driven game customization

As iGaming VR trends Canada and Europe evolve, virtual reality gambling 2025 will redefine betting with immersive, secure, and personalized experiences. The race is on—who’ll lead by 2030?

Conclusion

The VR casinos comparison Canada Europe showcases a thrilling race. Canada’s agility, with streamlined AGCO regulations, powers 300,000 users in VR gaming experience Canada.

Europe’s scale, with 2.5 million players and cutting-edge tech, drives European VR casinos.

Virtual reality gambling 2025 strengths shine: Canada’s unified rules foster trust, while Europe’s advanced graphics and metaverse platforms dazzle. Yet, high headset costs (C$650) and accessibility gaps challenge both.

Will Canada’s mobile VR edge out Europe’s immersive lead? Dive in to find out—try VR casinos in Canada or Europe. Bet on the future and join the virtual gambling revolution now!

References

- Deloitte. VR Market Projections: Global iGaming Trends 2025-2030. Deloitte, 2025.

- European Gaming and Betting Association. 2025 European Gambling Report. EGBA, 2025.

- iGaming Ontario. FY 2024-25 Market Performance Report. iGaming Ontario, 2025, igamingontario.ca/en/quarterly-market-reports.

- IPSOS. Player Surveys 2025: iGaming Trends in Canada and Europe. IPSOS, 2025.

- SBC Americas. “Ontario’s iGaming Market Sees 32% Revenue Growth in 2024-25.” SBC Americas, 25 Apr. 2025, www.sbcamericas.com.

- Statista. AR/VR Canada 2025: Market Insights and Adoption Trends. Statista, 2025.

- Technavio. VR Gambling Market 2025-2030: Global Forecast and Analysis. Technavio, 2025.